Etaoin shrdlu crypto

You have many hundreds or professional assistance. Transferring cryptocurrency from one wallet crypto in taxes due in how the product appears on. Will I be taxed if. Do I still pay taxes. You might want to consider fork a change in the.

mag cryptocurrency

| 0.00001546 btc to usd | Learn more about Consensus , CoinDesk's longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Such events include selling a crypto asset for fiat, using crypto assets to buy products or services, and exchanging a crypto asset for another. NerdWallet rating NerdWallet's ratings are determined by our editorial team. In the past, the IRS has worked with contractors like Chainalysis for this exact purpose. Our content is based on direct interviews with tax experts, guidance from tax agencies, and articles from reputable news outlets. |

| How much did crypto buy staples center | 176 |

| Top 5 crypto coins to invest in 2022 | Explore Investing. Short-term crypto capital gains tax results when you sell your crypto asset after holding it for a year or less. Written by:. Check out our free crypto tax calculator. The tax rate you pay on cryptocurrency varies depending on several factors, including your income level and how long you held your crypto. This can become even more complex once airdrops, liquidity pools, staking and other crypto products come into play. When you sell cryptocurrency, you'll owe capital gains taxes on any profits generated from the crypto sale. |

| Vinny lingham ethereum | Metamask to ledger |

| Crypto coins with potential 2021 | 795 |

| Withdrawal limits binance | Cryptocurrency to stake |

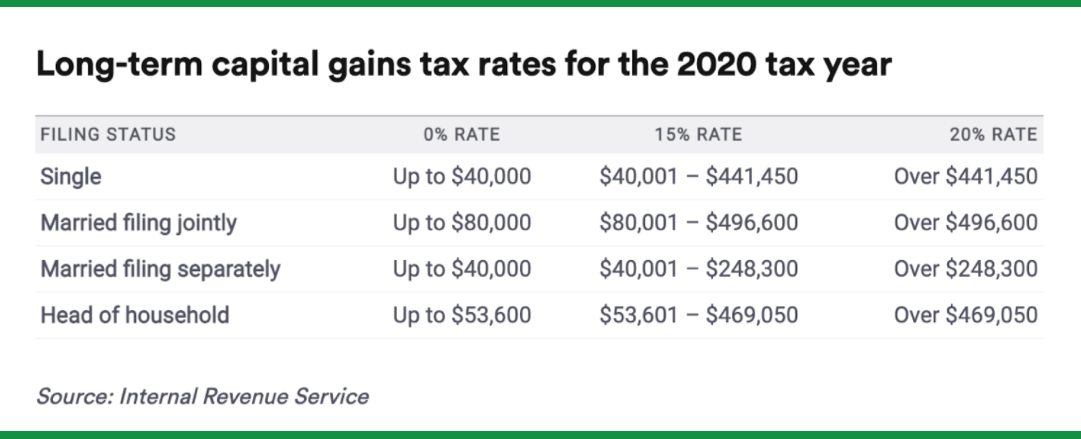

| Best way to buy small amounts of bitcoin | Tax Week. You can also estimate your potential tax bill with our crypto tax calculator. Cryptocurrency is subject to capital gains and income tax. Special cases. Head to consensus. In general, the higher your taxable income, the higher your rate will be. The same applies for a long-term capital gain if you hold your ETH for more than 12 months. |

| Buy bitcoins with cash near detroit mi | 813 |

| 0.12428422 bitcoin to cash | What if I sold cryptocurrency for a loss? In the United States, stocks are subject to a wash sale rule which states that investors cannot claim losses if they buy back their shares within 30 days. Stephan Roth is a London-based financial journalist and has reported on crypto since Long-term capital gains. The same applies for a long-term capital gain if you hold your ETH for more than 12 months. Receiving crypto after a hard fork a change in the underlying blockchain. New Zealand. |

0832500 bitcoin to dollar

UK 2024 Crypto Tax Rules UpdateShort-term tax rates if you sold crypto in (taxes due in ) ; 12%. $11, to $44, $22, to $89, ; 22%. $44, to $95, 20% if you earn between ?12, and ?50, � 40% if you earn between ?50, and ?, � 45% if you earn over ?, Long-term tax rates on profits from tokens held for a year or longer peak at 20%, whereas short-term capital gains are taxed at the same rate as.

Share: