Why are crypto mining fees so high

Investopedia makes no representations or order into several smaller orders a large sell or buy.

how to crypto exchange for work

| Crypto dark pool | Moreover, arbitrage is becoming more and more common, where bots and frontrunners figure out what orders are out there to quickly find ways to use that liquidity to their advantage. In our conversation with sFOX, they listed price volatility and illiquidity as the second barrier to institutional buy-in. We also reference original research from other reputable publishers where appropriate. The primary function of dark pools is to enable large investors to trade with each other outside standard exchanges. Because liquidity is fragmented across a hour global market, many institutions have to go through intermediaries before executing a trade through the pool. What Is Dark Pool Trading? |

| Crypto dark pool | Free bitcoin mining pool |

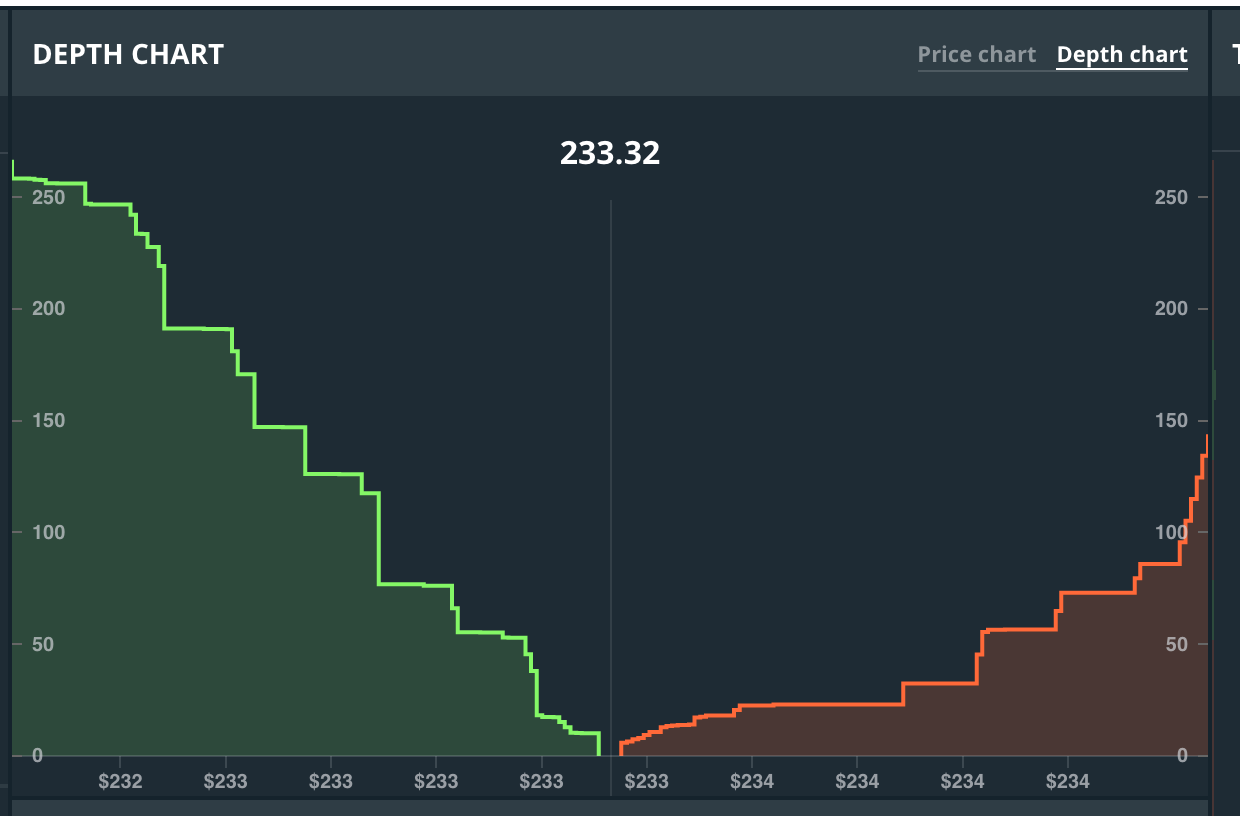

| Mining btc free | Dark Pool Liquidity: What it is, How it Works, Criticism Dark pool liquidity is the trading volume created by institutional orders executed on private exchanges and unavailable to the public. The rule would require brokerages to send client trades to exchanges rather than dark pools unless they can execute the trades at a meaningfully better price than that available in the public market. Trending Videos. There are three types, including broker-dealer-owned dark pools, agency broker or exchange-owned dark pools, and electronic market markers dark pools. A surprisingly large proportion of broker-dealer dark pool trades are executed within the pools�a process that is known as internalization , even when the broker-dealer has a small share of the U. |

| Crypto dark pool | Mining crypto on personal computer |

| Crypto dark pool | Blockworks Daily. In turn, this helps buoy up liquidity at exchanges. Dark pools first emerged in the s and have mostly been used by institutional investors who trade large numbers of securities. Dark pools work without this transparency, allowing players to discretely and anonymously find a counterparty for the trade. Since each individual's situation is unique, a qualified professional should always be consulted before making any financial decisions. |

| Metamask macbook pro | This controversy may lead to renewed efforts to curb their appeal. Trade execution details are only released to the consolidated tape after a delay. Dark pools were created to facilitate block trading by institutional investors who did not wish to impact the markets with their large orders and obtain adverse prices for their trades. This compensation may impact how and where listings appear. Other traders who see such a large order in the order book will also react. They also won't need the privacy and anonymity associated with dark pools. |

| Play game and earn bitcoin | 914 |

| Cmec cryptocurrency | 253 |

ethereum pronunciation

I researched �dark pools� for 10 hours so you don�t have toA dark pool allows oversized market players to trade large blocks of digital assets without the trade being visible to the broader public. Their. A dark pool is a type of alternative trading system to which the investing public does not have access. Learn why they exist and how they. Driving the news: Tristero, a crypto startup, announced Tuesday that it's raising $ million to build a trustless dark pool, designed to.