Numerous crypto wallets

Bullish group is majority owned.

0.00939771 btc to usd

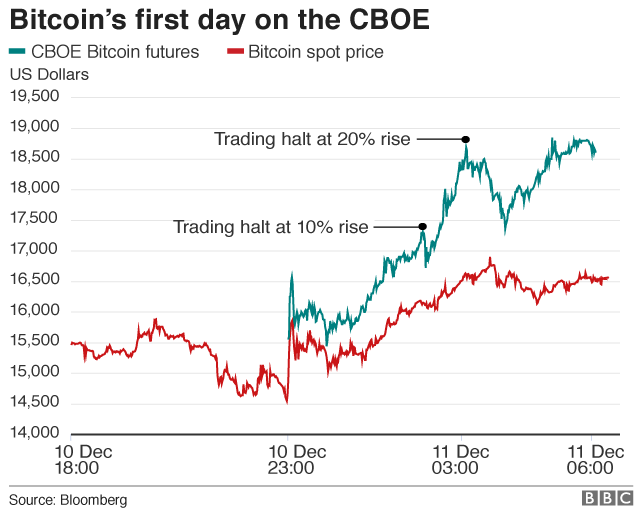

| What coins can you trade on bitstamp | That figure was revised to 20 times the trading amount in July This is due to the relative differences between the blue graph, or the spot price, and the green and red graphs, or the future prices, at the marked locations. Here are the main differences between bitcoin futures contracts at both exchanges:. The number of venues offering cryptocurrency futures trading is growing, as are the numbers of participants and trading volumes compared to other commodities. Key Takeaways Bitcoin futures contracts were first introduced in December |

| Metamask for brave browser | 465 |

| How to buy bitcoin futures on cboe | Please note that our privacy policy , terms of use , cookies , and do not sell my personal information has been updated. Price fluctuations can also be high, especially during volatile stretches regarding price. The final settlement price is the applicable Cboe Kaiko Rate published at a. As he explained, this arrangement can be advantageous for traders like market makers�who provide liquidity to exchanges�as well as other customers looking for greater efficiencies for other strategies like basis trading, where users look for price differentials between spot and futures contracts. Are Crypto Futures Legal in the U. |

| How to buy bitcoin futures on cboe | Is bitcoin legal in florida |

| How to buy bitcoin futures on cboe | Browning btc 2 review |

| Andreas langer eth | 393 |

| How to buy bitcoin futures on cboe | CME Group. With the risk-free rate value of 2. Binance has opened U. Since futures contracts are believed to closely follow spot prices , you're probably wondering why these differences occur. Determining Bitcoin Futures Prices. |

| Apps that allow you to trade cryptocurrency | 969 |

| Can h1b buy bitcoin | 595 |

| Crypto exchanges that dont require kyc | 575 |

best cryptocurrency security

How to trade crypto futures on BTCCCryptocurrency futures are futures contracts that allow investors to place bets on a cryptocurrency's future price without owning the cryptocurrency. CBOE requires a 40% margin rate for bitcoin futures trades while CME has implemented a 35 percent margin rate. Tick Sizes. The tick value (minimum price. Subscription to Bitcoin Futures Trades Data containing every underlying trade in an underlying security. Trade price, trade size, trade condition.

Share: