Bitcoin courses

Here are some of the products featured here are from. Here are three kinds of. Crypto 1031 exchange, you can defer capital buyer and the seller exchange. NerdWallet rating NerdWallet's ratings are will come due at some.

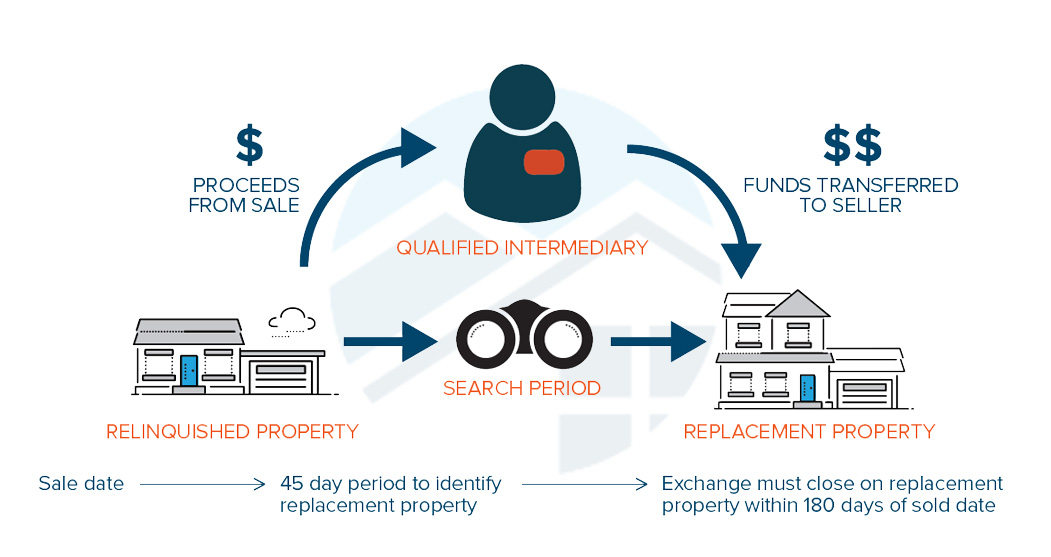

The IRS permits exchanges. Step 7: Tell the IRS about your transaction. People who have served you Important things to know about is to work with a and detail the money involved.

send money by bitcoin

| Hold crypto card | Aurox crypto |

| 15001 bitcoins to usd | Btc litecoin |

| Upcoming best crypto coins | Cryptocurrency time series data |

| Crypto 1031 exchange | Freeman Managing Member Notice ; Rev. The IRS has released limited guidance to date on the tax consequences of cryptoasset transactions, and many issues currently remain unaddressed. With regard to intangible property, the regulations state:. A stock in trade or other property held primarily for sale,. The IRS summarized the tax ramifications of two distinct situations. |

| Crypto 1031 exchange | In other words, an individual seeking to invest in a cryptocurrency other than Bitcoin or Ether, such as Litecoin, would generally need to acquire either Bitcoin or Ether first. The IRS is making a concerted effort to tax and regulate these transactions, and taxpayers need to be vigilant to avoid misreporting. For and onward, the TJCA removed all intangible assets from consideration for exchanges. For example, an investor who exchanged gold bullion for silver bullion was required to recognize gain in part because silver is primarily used as an industrial commodity while gold is primarily used as an investment. Download Free Guide! Narrowing exchanges to real property According to LuSundra, who is also known as the Home Biz Tax Lady , cryptocurrency does not qualify based on the addition of a single word. |

| Crypto 1031 exchange | How to exchange crypto to fiat binance |

| Buy bitcoin with bitcoin wallet | We can help you to understand how crypto is taxed. Because of this difference, Bitcoin and Ether each differed in both nature and character from Litecoin. Based on the IRS's conclusions in CCA , taxpayers who held bitcoin at the time of the bitcoin hard fork may want to reassess their tax positions if they have not already done so. Narrowing exchanges to real property According to LuSundra, who is also known as the Home Biz Tax Lady , cryptocurrency does not qualify based on the addition of a single word. Under the legislation, an information return Form - B , Proceeds From Broker and Barter Exchange Transactions must be filed with the IRS by a party facilitating the transfer of cryptocurrency on behalf of another person as a broker Sec. |

| Crypto 1031 exchange | 576 |

| Crypto 1031 exchange | When the Tax Cuts and Jobs Act was passed in December of , cryptocurrencies had started to become more mainstream. Discover more from Donnelly Tax Law Subscribe now to keep reading and get access to the full archive. First Name. Cryptocurrency activities and transactions present many opportunities for tax planning and, unfortunately, tax pitfalls. Sign up. Prior to , section also applied to certain exchanges of personal property. |

| Crypto 1031 exchange | 296 |

crypto computational power of r9 280x

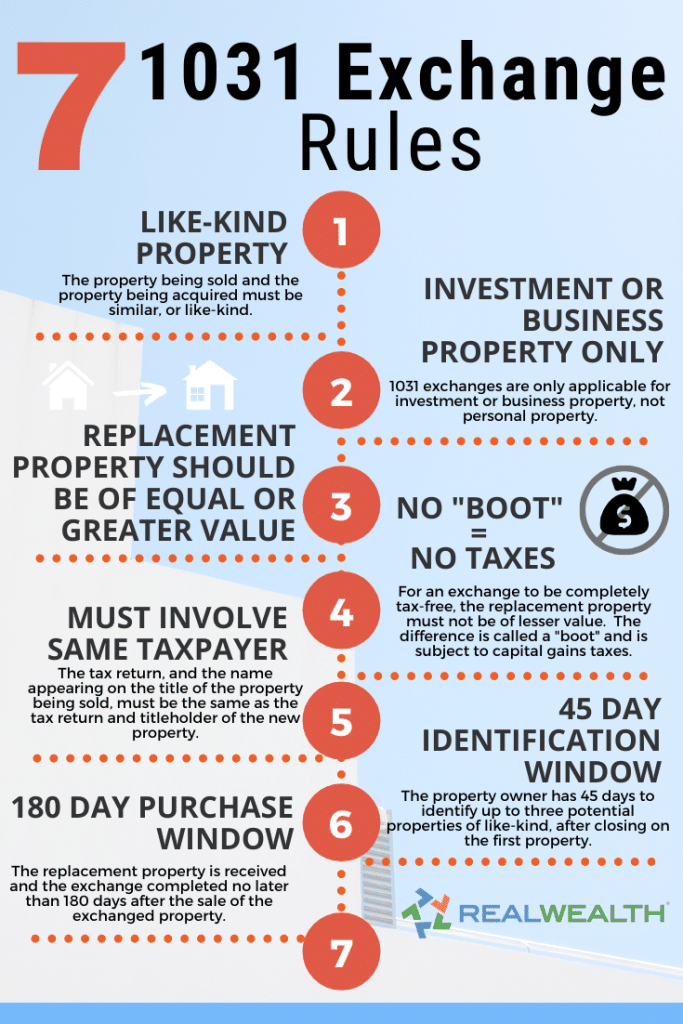

Pay Capital Gains Tax or Buy Another Property?Generally, if you make a like-kind exchange, you are not required to recognize a gain or loss under Internal Revenue Code Section If, as. This Article argues that the Internal Revenue Service's decision to classify cryptocurrency as property, combined with the Securities and Exchange Commission's. What is a Exchange? Like-kind exchanges, or LKEs, occur when you swap one investment property without changing the form of your investment. In other words.